If you are looking for a high-quality dividend growth company, you will be very interested in our next undervalued stock. Today we will discuss Williams-Sonoma (WSM), the upscale home goods retailer.

I would love to buy more Williams-Sonoma, Inc. (WSM) is a company I own. So it seems like an excellent time to pick up some shares. The stock is trading at $114.79 per share as of this writing. In this article, we will determine if the company is undervalued and deserving of our hard earn money.

Based on the Fastgraph, the stocks will return over 25.5% per year for the next three years at the current price.

Overview of Williams-Sonoma

Williams-Sonoma, Inc. is an American retailer with a prominent position in upscale home furnishings and gourmet cookware. With its origins dating back to 1956, Williams Sonoma has established itself as a leading brand offering many high-quality and sophisticated products designed to elevate its customers’ culinary and home experiences.

WSM stock is down 48.6% since it’s all-time high in November 2021. The main reason for the share price decrease has little to do with the company itself, as earnings are expected to decrease 13% in 2023 but increase 7% in 2024, which is still over a 100% rise since 2019. Instead, it is due to the overall market being down since then. Also, the stock was very much overvalued in November 2021.

The current stock price of $114 (as of this writing) is near the low end of the 52-week range, between $101 and $176 per share. Thus, WSM seems like a stock in the right place to buy up shares.

Affiliate

If you want to learn more about investing and dividends, then I suggest taking a course. The Simply Investing Course is a good value and fairly comprehensive. It consists of 10 modules and 27 lessons. You get lifetime access and 1-month access to the Simply Investing Report & Analysis Platform. Coupon Code – DIVPOWER15.

The Simply Investing Report & Analysis Platform analyzes 6,000+ stocks with 120 metrics and financial data. It include portfolios, watch lists, dividend income, e-mail alerts, etc. The best part is the list of top ranked stocks based on the 12 Rules of Simply Investing. Coupon Code – DIVPOWER15.

WSM Dividend History, Growth, and Yield

We will look at WSM’s dividend history, growth, and yield. We will then determine if it’s still a good buy at current prices.

WSM is considered a Dividend Contender, a company that has increased its dividend for over 18 years.

In this case, Williams-Sonoma stock has increased its dividend for 18 consecutive years. WSM’s most recent dividend increase was 15.4%, announced in March 2023.

Dividend Growth

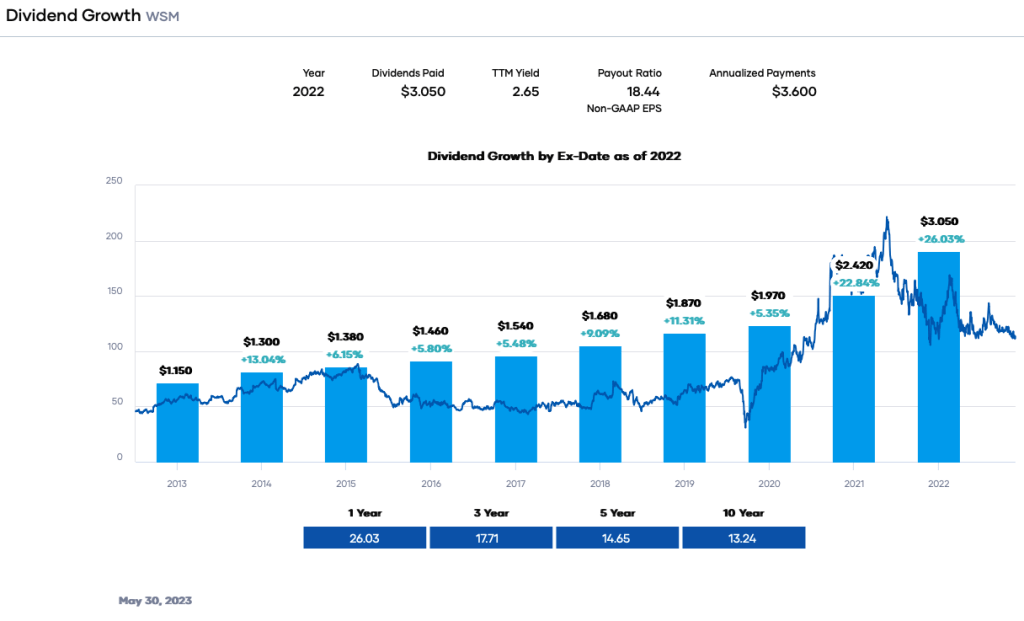

Additionally, according to Portfolio Insight*, WSM has a five-year dividend growth rate of about 14.65%, which is impressive considering how fast inflation increased last year and this year. The 10-year dividend growth rate is roughly the same rate of ~13.2%. However, the dividend growth rate has been increasing in recent years.

Something worth noting is that WSM stock continued to pay its dividend during the most challenging period in the last 100 years. Many businesses and industries cut or suspended dividend payments during the COVID-19 pandemic. However, unlike many other stocks, WSM continued to pay out its dividend and increased them. That is very noteworthy. This fact alone leads me to believe in the strength of the company and the fact that management is focused and committed to the dividend policy.

Dividend Yield

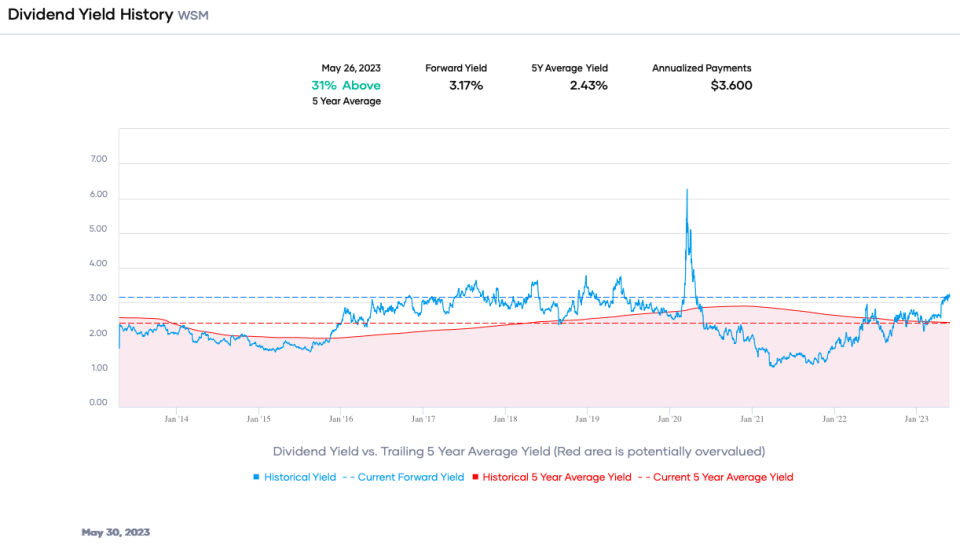

The company has an excellent dividend yield of approximately 3.17%, higher than the average dividend yield of the S&P 500 Index. This dividend yield is an excellent initial yield for dividend growth-driven investors. Additionally, with the company’s recent dividend increase rate, I can see over 5% yield-on-cost (YOC) in the next eight years.

WSM’s current dividend yield is higher than its 5-year average dividend yield of ~2.43%. I like to look at this metric because it offers a good idea if a company is undervalued or overvalued based on the current and 5-year average yield. Stock price and dividend yield are inversely related. The dividend yield decreases if the stock price increases, and vice versa.

Dividend Safety

Is the current dividend safe? This metric is critical to look at as a dividend growth investor. Undervalued dividend stocks sometimes present a “value trap,” and the stock price can continue to decline.

We must look at two critical metrics to determine if the dividend payments are safe yearly. The first one is adjusted operating earnings (EPS), and afterward, we must examine free cash flow (FCF) or operating cash flow (OCF) per share.

Analysts predict WSM stock will earn an EPS of about $13.66 per share for the fiscal year (FY) 2023. Analysts are 58% accurate when forecasting WSM’s future EPS. Also, the company beats these estimates 33% of the time. In addition, the company is expected to pay out $3.36 per share in dividends for the entire year. These numbers give a payout ratio of approximately 24.6% based on EPS, a conservative value, leaving the company with much room to continue to grow its dividend.

I am enthusiastic about having a 30% or lower dividend coverage with a dividend yield of ~3.1% with high future growth. At this point, it will allow the company to continue to grow its dividend at a mid-teen-digit rate without sacrificing dividend safety. In addition, WSM has a dividend payout ratio of 28% on an FCF basis. As a result, the dividend is well covered by both EPS and FCF.

WSM Revenue and Earnings Growth / Balance Sheet Strength

We will now look at how well WSM performed and grew its EPS and revenue over the years. When valuing a company, these two financial metrics are on my list to analyze. Without revenue growth, a company cannot have sustainable EPS growth and continue paying a growing dividend.

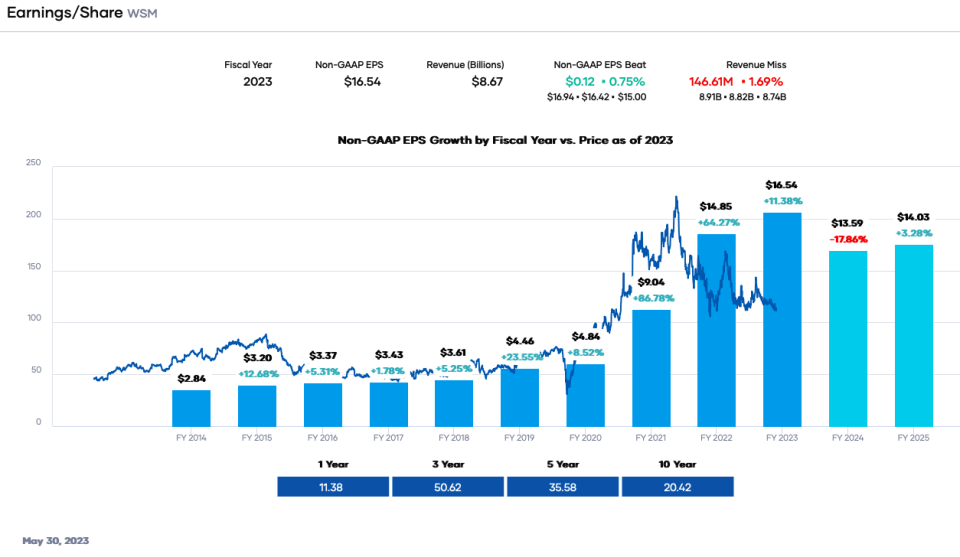

WSM revenue has been growing reasonably at a compound annual growth rate (CAGR) of about 7.9% for the past ten years, according to Portfolio Insight*. Net income did much better, with a CAGR of ~16.8% over the same ten-year period. However, EPS has grown 20.4% annually for the past decade and at a CAGR of 35.6% over the past five years.

Revenue, net income, and FFO grew well over the years. Next, we will determine if this stock is attractive based on its valuation and dividend yield. In the meantime, analysts predict that the company will grow EPS at a 3.0% rate over the next five years.

Last year’s EPS increased from $14.85 per share in FY2021 to $16.54 per share for FY2022, an increase of 11%. Additionally, analysts expect WSM stock to make an EPS of $13.66 per share for the fiscal year 2023, which would be a ~17% decrease compared to FY2022. This is something I don’t see that future earnings are expected to be lower than the previous year, but FY2023 earnings are still 182% higher than 2019, which was only a few years ago.

The company has a solid balance sheet. WSM has an S&P Global credit rating of BBB, a lower- investment-grade rating. Also, the company has an excellent debt-to-equity ratio of 0.9. Thus, the company has an acceptable balance sheet to overcome recessions, adding to the dividend safety. Lastly, the stock earns a dividend quality grade of an ‘A+.’

WSM Competitive Advantage

WSM has several competitive advantages that contribute to its success in the company. For example, Williams Sonoma has established a reputable and well-recognized brand known for its commitment to quality, craftsmanship, and elegance. In addition, the brand’s long-standing presence and loyal customer base give it a competitive edge over newcomers and lesser-known competitors.

Also, Williams-Sonoma has successfully integrated both physical retail stores and an online platform, creating an omnichannel presence. This approach allows customers to seamlessly switch between in-store and online experiences, providing convenience and flexibility. In addition, the company’s online platform expands its reach, enabling it to tap into a broader customer base and adapt to changing consumer preferences.

However, there are risks with investing in WSM. The retail industry is highly competitive, particularly in the home furnishings and kitchenware segments. Williams-Sonoma faces competition from both traditional brick-and-mortar retailers and online platforms. The presence of well-established competitors and emerging players could potentially impact market share and profitability.

In addition, consumer tastes and preferences evolve, and Williams Sonoma must stay attuned to these changes. Failure to anticipate and respond effectively to shifting design, lifestyle, or sustainability trends may result in decreasing customer interest and demand.

Valuation for William-Sonoma

One of the valuation metrics I like to evaluate is the dividend yield compared to the past few years’ histories. I also want to look for a reduced price-to-earnings (P/E) ratio based on the past 5-year or 10-year averages. Finally, I like to apply the Dividend Discount Model (DDM). I employ a DDM analysis because a company’s value ultimately equals the sum of the future cash flow that the company can provide.

Let’s first look at the P/E ratio. WSM has a P/E ratio of ~8.5X based on FY 2023 EPS of $13.66 per share. The P/E multiple is excellent compared to the past 5-year P/E average of 14.4X. If WSM were to vert back to a P/E of 14.4X, we would obtain a price of $196.70 per share.

Now let’s look at the dividend yield. As I mentioned, the dividend yield currently is 3.1%. There is good upside potential as WSM’s 5-year dividend yield average is ~2.3%. For example, if WSM were to return to its dividend yield 5-year average, the price target would be $146.09.

The last item I like to look at to determine a fair price is the DDM analysis. I factored in a 10% discount rate and a dividend growth rate of 8%. I use a 10% discount rate because of the lower dividend yield. Moreover, the projected dividend growth rate is conservative and lower than its past 5-year average. These assumptions give a fair price target of approximately $181.44 per share.

If we average the three fair price targets of $196.70, $146.09, and $181.44, we obtain a reasonable, fair price of $174.74 per share, giving WSM a possible upside of 52% from the current price of $114.79 share price.

Final Thoughts on Williams-Sonoma (WSM)

Williams-Sonoma is a high-quality company that should meet most investors’ requirements. The company has a market-beating 3.1% dividend yield and a long-term dividend growth history. In addition, past earnings growth has been outstanding. However, good prior performance does not mean it will be the same in the future. But at the current price, the stock looks attractive.

Disclosure: I do own shares of WSM

You can also read Lowe’s (LOWE): A Worthy Dividend King by the same author.

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Sure Dividend Pro Plan is an excellent resource for DIY dividend growth investors and retirees. Try it free for 7 days.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Related