I reviewed Visa (V) in this December 15, 2022 Visa’s Attractive Valuation Makes It A Buy post. I now take this opportunity to review Mastercard Incorporated (MA).

MA shareholders are undoubtedly aware that MA exhibits share price volatility. Unless you are a day trader who thrives on share price volatility, it is possible this volatility might not mesh with your investor profile. Investors who panic at the slightest change in the value of their investments may find MA to be an unsuitable investment.

It is not my place to suggest how you should invest. From personal experience, however, it is wise to invest in a company from the perspective of being a business owner. Business owners typically do not frequently (multiple times daily?) concern themselves with the change in the value of their investment.

Two of the world’s savviest investors (Warren Buffett (Chairman and CEO of Berkshire Hathaway) and Charlie Munger (Vice-chairman of Berkshire Hathaway)) have dispensed the following wisdom on multiple occasions.

‘The market is a voting machine in the short run but a weighing machine in the long run’.

We should not, therefore, fixate on share price nor should we invest in any company merely because we think the share price is likely to increase. Instead, we should invest in companies we understand and believe have a very strong probability of offering long-term value.

My rationale for investing in MA is that I like its business model and long-term growth prospects.

Rather than bury the disclosure that I am a MA shareholder at the end of this post, I disclose that MA was my 3rd largest holding after Visa (V) and Chevron (CVX) when I completed my January 2023 Investment Holdings Review. Although I am not scheduled to complete a similar review for another month, I think MA is currently my 2nd largest holding having subsequently bypassed CVX.

Affiliate

If you want to learn more about investing and dividends, then I suggest taking a course. The Simply Investing Course is a good value and fairly comprehensive. It consists of 10 modules and 27 lessons. You get lifetime access and 1-month access to the Simply Investing Report & Analysis Platform. Coupon Code – DIVPOWER15.

The Simply Investing Report & Analysis Platform analyzes 6,000+ stocks with 120 metrics and financial data. It include portfolios, watch lists, dividend income, e-mail alerts, etc. The best part is the list of top ranked stocks based on the 12 Rules of Simply Investing. Coupon Code – DIVPOWER15.

Business Overview

Just about everyone in the developed world has heard of MA. However, some people do not truly understand the nature of its operations and mistakenly think MA assumes the credit risk associated with all its branded cards. This, however, is not the case. The issuing banks assume the credit risk.

In addition, I am continually amazed at the number of people who fall victim to fraudsters claiming to be V’s or MA’s fraud department. Both V and MA are certainly heavily involved in fraud mitigation but they do not have fraud departments that reach out to cardholders.

If what is reflected above comes as a surprise to you, I suggest you familiarize yourself with MA by reading ‘Item 1. Business’ and ‘Item 1A. Risk Factors’ found at the beginning of MA’s FY2022 Form 10-K.

FedNow Service

In July 2023, the United States Federal Reserve will launch a new instant payment infrastructure called the FedNow Service; more than 120 banks and payment providers have been part of the pilot program since 2021.

This service, developed by the Federal Reserve, will allow financial institutions of every size across the US that elect to participate in the FedNow Service to provide safe and efficient instant payment services.

Through financial institutions, businesses and individuals will be able to send and receive instant payments in real-time 24/7 every day of the year. A significant benefit of this service is that recipients will have full access to funds immediately.

While the FedNow Service will be launched in July 2023, it will be deployed in phases.

Initially, the FedNow Service will include bill payments and account-to-account transfers. This will be practical for users who might be on a tight budget and who are susceptible to late payment fees.

The service will enable a user to pay a bill when it is due and receive immediate confirmation the payment is accepted. A real benefit of this service is that there is no risk of overdrawing a bank account or incurring overdraft fees because a bank must verify sufficient funds before initiating an instant payment. Furthermore, instant account-to-account transfers would allow users to easily manage accounts held at different banks.

An explanation of this service is provided in this Federal Reserve Bank Services video.

This new service may be perceived as a payment method that could divert some of MA’s existing volumes. MA, however, has stated that it appreciates competition because it forces it to become a better company.

For now, MA is closely monitoring the success of this new Fed service.

CEO and NEO Compensation

I reference the Compensation Discussion and Analysis component within MA’s 2023 Proxy Statement; this commences on page 64.

The structure of MA’s compensation program and individual pay decisions should be designed to support the company’s long-term business strategy that is designed to ultimately create value for shareholders and other key stakeholders, including MA’s employees, customers, consumers and the communities in which the company operates.

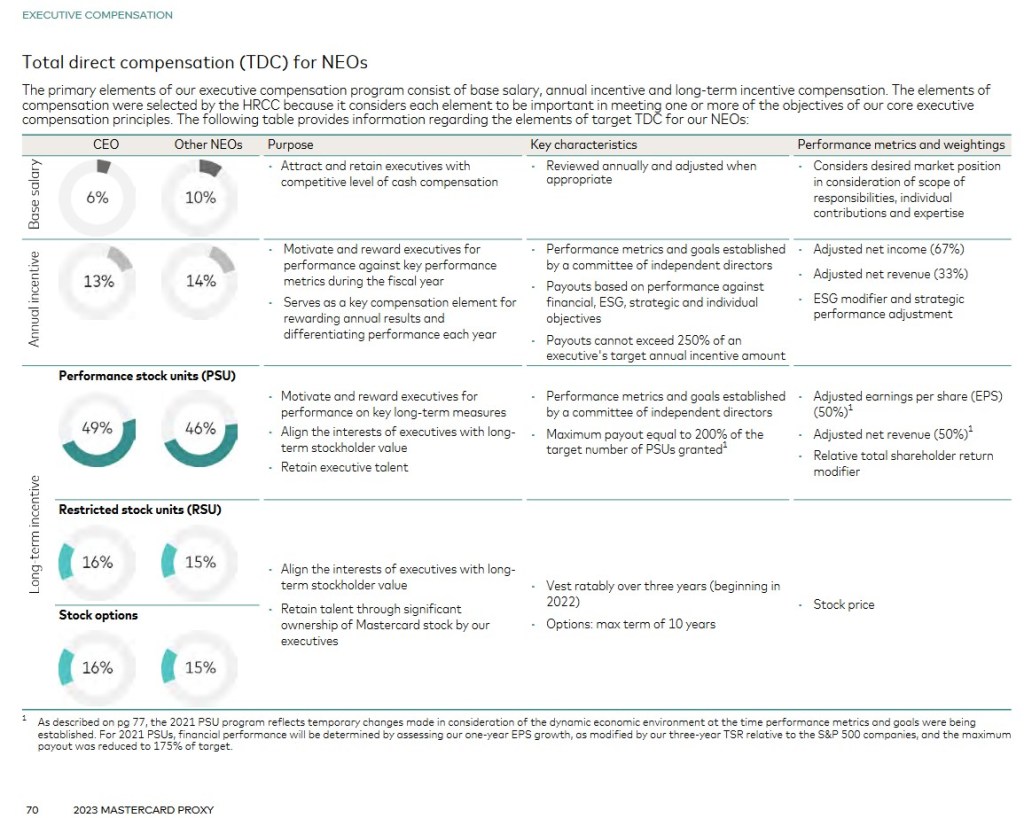

I am particularly interested in the percentage weighting of each compensation element that comprises the target Total Direct Compensation (TDC) of a company’s CEO and the Named Executive Officers (NEO). If the long-term incentive component makes up a large percentage of the TDC, I envision that a company’s CEO and the NEOs will make decisions that are closely aligned with the interests of long-term shareholders.

The Compensation Discussion and Analysis component within MA’s 2023 Proxy Statement is several pages in length. However, the following illustrates the percentage weighting of each compensation element comprising the CEO’s and NEOs’ TDC.

Looking at the CEO’s compensation package, we see that 19% of the TDC is Base Salary and Annual Incentive (24% for other NEOs). The structure of the compensation packages for these executive officers is heavily weighted toward long-term targets. This suggests to me that their interests are closely aligned with the interests of long-term shareholders.

Mastercard’s Financial Results

Q1 2023

On April 27, 2023, MA released its Q1 2023 financial results. Material related to this earnings release is accessible here.

When comparing MA’s outlook relative to historical results, we must review the Supplemental Operational Performance Data that reflects MA’s disaggregated results related to its Russian operations.

Beginning in February 2022, in response to the Russian invasion of Ukraine, the United States, the European Union and other governments imposed sanctions and other restrictive measures on certain Russian-related entities and individuals. In March 2022, MA suspended its business operations in Russia.

These actions impacted MA’s FY2022 results. As a point of reference, ~4% of MA’s net revenues in FY2021 were derived from business conducted within, into and out of Russia.

Despite having had to withdraw from Russia, MA continues to ‘fire on all cylinders’.

FY2023 Outlook

It is important to gauge how a company has performed. However, it is perhaps more important to determine how a company is likely to perform.

On the Q1 earnings call, management stated that overall consumer spending remains healthy, albeit with some recent moderation in domestic spending in the US. This is partly due to lower tax refunds in 2023 relative to 2022.

For FY2023, MA’s outlook has improved modestly, reflecting stronger-than-expected performance in Q1.

Net revenue growth for FY2023 is now expected to be in the low teens on a currency-neutral basis; this excludes acquisitions and special items. Were it not for the Russia-related revenues being excluded, this growth rate would be higher by ~1.5%.

The recovery in cross-border travel continues with inbound travel to all regions now well above 2019 levels.

China made up 2% of outbound and 1% of inbound cross-border travel in 2019. In that country, outbound cross-border travel increased in Q1 2023 to ~65% of Q1 2019 levels, while inbound reached 45% on the same basis.

While MA is monitoring several macro and geopolitical factors, its base case scenario assumes consumer spending remains resilient and cross-border travel continues to recover.

Credit Ratings

We each have our respective tolerance for risk, and therefore, it is not for me to decide what is an appropriate risk for you.

I do, however, encourage you to determine your true risk tolerance. If a permanent impairment of an investment leads to considerable grief, then it would be wise to very seriously consider whether an investment’s ‘potential return’ warrants the risk.

Naturally, every investment has a risk/reward tradeoff. Even investing in great companies such as MA comes with its risks; we merely need to read Item 1A. Risk Factors in MA’s FY2022 Form 10-K.

As equity investors, we should consider that our risk exceeds that of unsecured debtholders. When we invest in companies whose unsecured long-term debt is rated near the bottom tier within the group of investment grade ratings, shareholders are exposed to non-investment grade risk.

I try to control my degree of credit risk. This is why I avoid companies whose credit ratings are non-investment grade, or 1 tier above non-investment grade, and the outlook is negative.

Rating Upgrade

Moody’s currently assigns an Aa3 rating to MA’s senior unsecured long-term domestic debt; this rating was upgraded on November 16, 2022 from A1.

This rating is the lowest tier of the high-grade investment grade category. It defines MA as having a very strong capacity to meet its financial commitments; the rating differs from the highest-rated obligors only to a small degree.

S&P Global currently assigns an A+ rating to MA’s senior unsecured long-term domestic debt; this rating has been in effect since November 2018 and is one level below that assigned by Moody’s.

This rating is the highest tier of the upper-medium-grade investment grade category. It defines MA as having a strong capacity to meet its financial commitments. However, MA is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

MA’s credit risk suits my conservative investor profile.

Dividend Metrics

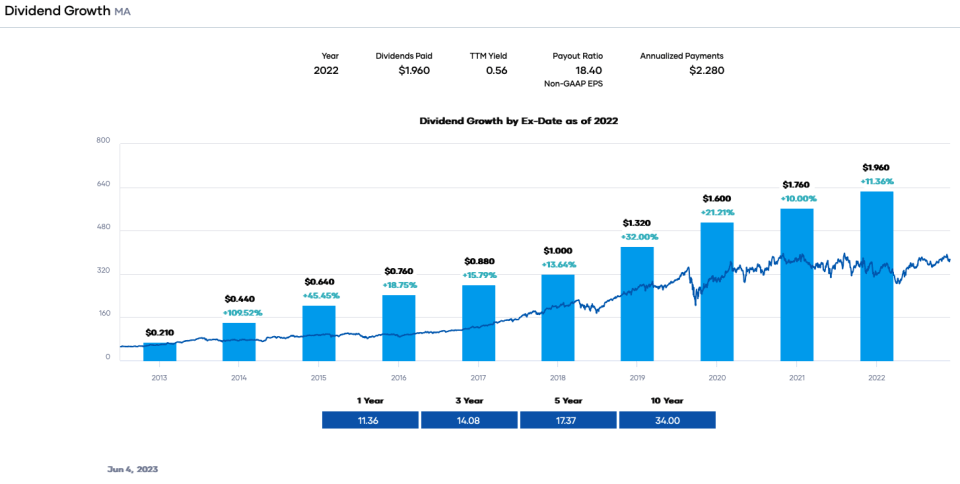

MA distributes a quarterly dividend as evidenced by the dividend history. The dividend metrics, however, are unlikely to be the deciding factor to invest in the company.

Looking at MA’s investment return over the past decade, we see that dividend income represents but a small fraction of the total investment return.

MA’s annual dividend yield has historically been under 1% and is likely to remain under 1% going forward. However, MA has been rapidly increasing its dividend at a double-digit rate or the past 13-years. It is on the Dividend Contenders list.

As in the past, a large percentage of MA’s total future investment return will probably be derived from capital gains. This makes it exceedingly important to acquire shares when they are reasonably/attractively valued.

Share Repurchases

The weighted average number of Class A diluted common stock outstanding in FY2013 – FY2022 (in millions of shares) is 1,215, 1,169, 1,137, 1,101, 1,072, 1,047, 1,022, 1,006, 992, and 971. This has been reduced to 956 in Q1 2023.

In December 2022, November 2021 and December 2020, MA’s Board approved share repurchase programs of the Class A common stock authorizing the repurchase of up to $9B, $8B, and $6B, respectively.

In FY2022, MA repurchased 25.7 million shares of its common stock for ~$8.8B at an average price of $340.60.

The following table summarizes MA’s share repurchases of its Class A common stock in Q1 2022 and Q1 2023.

The following table reflects the remaining share repurchase authorization.

Mastercard’s Valuation

MA’s FY2013 – FY2022 P/E ratio is 32.98, 29.61, 29.87, 28.52, 35.28, 38.11, 44.30, 53.59, 44.20, and 34.74.

During FY2013 – FY2022 and Q1 2022 and Q1 2023, MA’s diluted EPS and adjusted diluted EPS were as follows:

In several fiscal years, MA has had various adjustments which can lead to a meaningful variance between GAAP and non-GAAP earnings.

In Q1 2023, MA generated $2.80 in adjusted diluted EPS versus $2.47 in GAAP diluted EPS. It appears that several analysts who cover MA anticipate the remainder of FY2023 will be stronger than Q1 as evidenced by the FY2023 adjusted diluted EPS range reflected below. Multiplying MA’s $2.80 of adjusted diluted EPS in Q1 by 4 quarters gives us $11.20. We, however, see that the lowest broker estimate is $11.94.

Adjusted diluted EPS estimates from the brokers which cover MA often range widely. Estimates for FY2023 are no exception; there is currently a $0.76 variance between the low/high FY2023 adjusted diluted EPS estimates.

The following valuations are based on MA’s ~$374 share price at the time this post is composed.

- FY2023 – 35 brokers – mean of $12.28 and low/high of $11.94 – $12.70. Using the mean estimate, the forward adjusted diluted PE is ~30.5.

- FY2024 – 36 brokers – mean of $14.58 and low/high of $13.68 – $15.32. Using the mean estimate, the forward adjusted diluted PE is ~25.7.

- FY2025 – 15 brokers – mean of $17.32 and low/high of $16.74 – $18.31. Using the mean estimate, the forward adjusted diluted PE is ~21.6.

As noted at the outset of this post, MA exhibits share price volatility. It is, therefore, very possible that MA’s valuation between the time I compose this post and the time you read it could have changed significantly. I, therefore, strongly encourage you to reassess MA’s valuation when you decide to purchase shares.

Mastercard Is A Compelling Investment – Final Thoughts

While MA’s annual revenue has grown from ~$8.3B in FY2013 to ~$22.24B in FY2022, I expect strong growth over the coming years.

Both MA and V have been resilient through challenging economic conditions. This gives me comfort that my investments are unlikely to suddenly implode (Silicon Valley Bank, Signature Bank, First Republic Bank, and Credit Suisse investors would have been better off investing in MA and V).

While MA’s resilience makes it a compelling investment, I decided long ago that I would not invest in one OR the other. I have invested in MA AND V. So far, I have no regrets.

Author Disclosure: I am long MA and V. I disclose holdings held in the FFJ Portfolio and the dividend income generated from the holdings within this portfolio. I do not disclose details of holdings held in various tax-advantaged accounts for confidentiality reasons.

Author Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

Related articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Sure Dividend Pro Plan is an excellent resource for DIY dividend growth investors and retirees. Try it free for 7 days.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

I am a self-taught investor and run the Financial Freedom is a Journey blog. I have invested in the North American equities markets for over 34 years. I retired from a career in banking and continue to invest as this is something about which I am passionate.

Related